Understanding BVN Code Check: A Comprehensive Guide

The BVN code check is an essential process for individuals in Nigeria, designed to enhance the security of banking transactions. With the rise of digital banking, understanding how to check your Bank Verification Number (BVN) has become increasingly vital. This article aims to provide you with all the necessary information regarding the BVN code check, including its significance, how to check your BVN, and the benefits it brings to your financial safety.

In this guide, we will explore the BVN code, its role in the Nigerian banking system, and the steps required to perform a BVN code check. Additionally, we will discuss the implications of the BVN for both individuals and financial institutions, ensuring that you have a clear understanding of why maintaining your BVN is crucial for financial security.

By the end of this article, you will gain insights into the BVN code check process, enabling you to manage your banking activities more effectively. Let's dive into the details of this important aspect of financial identity verification.

Table of Contents

- What is BVN?

- Importance of BVN in Nigeria

- How to Check Your BVN

- Benefits of Having a BVN

- Common Issues and Solutions

- BVN for International Transactions

- Data Privacy and BVN

- Conclusion

What is BVN?

The Bank Verification Number (BVN) is an 11-digit unique identification number assigned to every bank customer in Nigeria. It serves as a means of verifying a customer’s identity and linking their biometric data to their bank accounts.

Launched by the Central Bank of Nigeria (CBN) in 2014, the BVN initiative aims to reduce fraud and enhance banking security. Every bank customer is required to register for a BVN, which is mandatory for opening and operating bank accounts in Nigeria.

Importance of BVN in Nigeria

Understanding the importance of the BVN is crucial for every bank customer in Nigeria. Here are several reasons why BVN is significant:

- Fraud Prevention: The BVN helps in reducing cases of identity theft and fraud in the banking sector.

- Financial Inclusion: BVN promotes financial inclusion by providing a unique identifier for unbanked populations.

- Access to Products: Many financial products and services require a BVN for eligibility.

- Transaction Security: BVN enhances transaction security, ensuring that only authorized individuals can access their accounts.

How to Check Your BVN

Checking your BVN is a straightforward process. Here are several methods you can use:

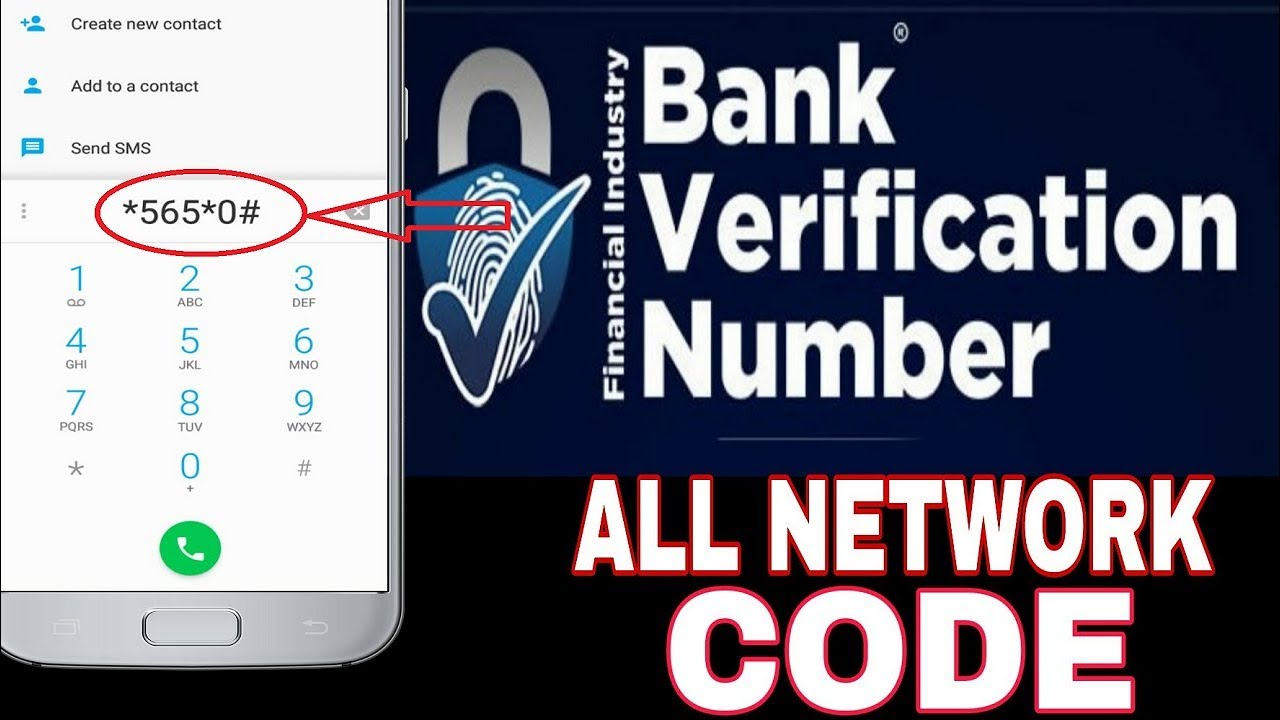

Using USSD Codes

One of the easiest ways to check your BVN is through USSD codes. Different banks have specific codes you can dial. For example:

- Access Bank: Dial *565*0#

- Zenith Bank: Dial *966*0#

- First Bank: Dial *894*0#

Follow the prompts to retrieve your BVN.

Checking Online

You can also check your BVN online through your bank’s official website. Most banks have a BVN checking option where you can input your details to retrieve your BVN.

Contacting Your Bank

If you encounter difficulties with the above methods, you can always contact your bank's customer service for assistance in retrieving your BVN.

Benefits of Having a BVN

Having a BVN comes with numerous benefits, including:

- Increased Security: Protects your account from unauthorized access.

- Faster Transactions: BVN allows for quicker processing of transactions.

- Access to Credit: A BVN is often required for accessing loans and credit facilities.

- Ease of Banking: Simplifies the process of banking across multiple institutions.

Common Issues and Solutions

While checking your BVN is generally straightforward, some common issues may arise:

- Incorrect BVN: Ensure you input the correct details when checking.

- Network Issues: Wait for a stable connection if using USSD codes.

- Unregistered BVN: If you haven’t registered for a BVN, visit your bank for assistance.

BVN for International Transactions

For individuals engaging in international transactions, the BVN plays a crucial role. It is often required for cross-border banking services, ensuring compliance with international financial regulations.

Data Privacy and BVN

With the increasing concern about data privacy, it is essential to understand how your BVN data is protected. Banks are mandated to keep your BVN information confidential and secure, and you should only share your BVN with trusted entities.

Conclusion

In summary, the BVN code check is an essential aspect of banking in Nigeria that enhances security and promotes financial accountability. By understanding how to check your BVN and recognizing its importance, you can better manage your banking activities. We encourage you to take action by checking your BVN today and ensuring your financial safety.

If you found this article helpful, please leave a comment, share it with others, or explore more articles on our site to enhance your financial knowledge.

Thank you for reading, and we hope to see you again for more insightful content!

Cats With Weird Names: A Fun Exploration

Dana Blumberg Instagram: Exploring The Life Of A Social Media Influencer

2024's Hip Hop: The Evolution Of The Genre And Its Future